by My Commercial Capital | Feb 24, 2023 | Blog

Business taxes are an unavoidable expenditure for any company, but there are many ways to reduce them. This article covers some methods to save money when tax season hits.

Use Environmentally Friendly Vehicles

If your business uses vehicles, you can cut its business tax burden by prioritizing environmentally friendly vehicles. For instance, some electric vehicles trigger a tax credit.

Invest in Solar Energy

Companies that invest in solar energy have two resulting avenues toward reducing their business taxes. One, known as the investment tax credit, is available to companies that install solar-energy-generating equipment. This credit triggers in the tax year the company installs the equipment.

The other tax-reducing perk is known as the production tax credit, which lowers taxes if a company generates electricity by solar means or with certain alternative technologies. This credit lasts for 10 years after the solar system or other technology goes into use.

Donate to Charity

Many small businesses make donations to charity. This can lead to positive press and a good feeling among employees, but it also has a financial benefit, as donations often can double as tax deductions. Making donations just for the tax write-off isn’t ideal; however, if your company is going to make donations for a good reason, it might as well reduce its business tax obligations in the process.

Utilize Depreciation

Depreciation is a widely used method that can lower business tax payments year after year. It does so by letting companies offset the costs caused by the natural deterioration of equipment and other property over time. Certain eligibility guidelines apply — for instance, land is not depreciable — but you may be surprised at how much of your business’s property qualifies for depreciation.

To learn more about financing in the business world, check out My Commercial Capital’s other blog posts. You can also contact us to hear about individually tailored funding solutions.

by My Commercial Capital | Feb 21, 2023 | Blog

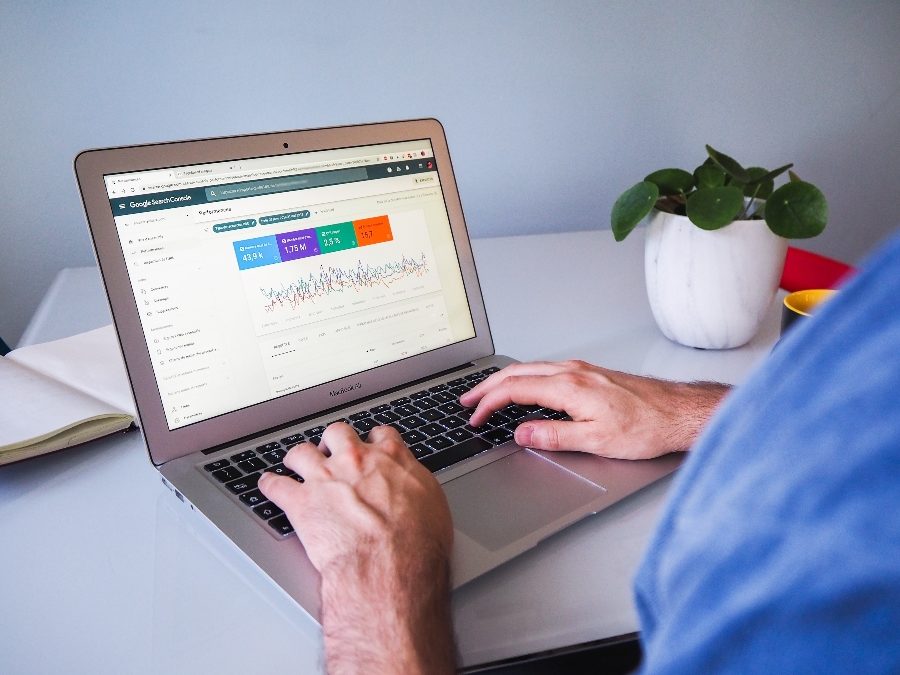

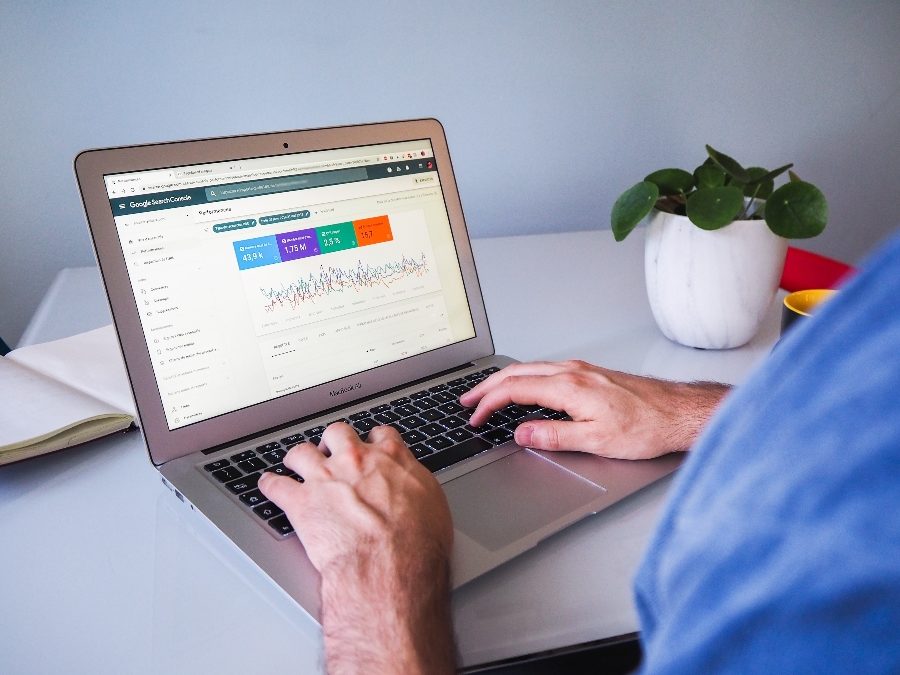

Building your business website is step one of your ongoing search engine optimization strategy. An SEO agency can help you rank higher in search results, increasing your visibility to a more significant number of potential clients. Maintaining your site, building links, and gaining traffic require continual management and adjustment to ensure growth for your company.

A professional company with the experience and knowledge to execute optimization techniques can give you an advantage over your competitors. These agencies handle the various components that affect your ranking on search engine results pages.

Research Your Target Audience

An SEO company identifies how your current website performs and compares it with the competition. Professionals can determine which keywords your target market searches for, helping you connect with the people most interested in what your organization offers. They can maximize your budget by focusing on the areas that will have the most significant impact.

SEO Audit

The first step in keeping your website on track is to analyze your existing efforts. This process identifies errors or issues that may be hurting your search engine rank. With knowledge of best practices, these specialists can create a plan that helps enhance your performance in online searches.

Update Your Website Design

An SEO agency can analyze your current site and decide which changes are necessary to improve traffic to your pages. You may require adjustments to your content to ensure your copy connects you to people who can benefit from your services. With the correct keyword practices, you can increase your organic search traffic. Your site may also benefit from design updates that create a more user-friendly experience.

Manage Off-Page SEO

You may not realize you need to address mentions of your company off your website. Your search traffic may suffer if you have negative reviews that you never answered, undesirable backlinks, or inaccurate citations of your name, address, and phone number. Experts can update your directory listings, ensure NAP consistency and obtain authentic reviews that add credibility to your site.

Ongoing Analysis

Unfortunately, optimization techniques are not a “set it and forget it” tactic. SEO requires continual management and updates to keep up with changing algorithms, new information, and shifts in user behavior. An SEO agency will test different approaches, analyze data and examine successful conversions to get the best results for your company.

Maintaining your SEO practices requires a significant amount of time and knowledge. Professionals with experience can accelerate your search traffic to help your operation thrive.

Seek Expert Assistance

The best SEO improves your website content and supports other marketing techniques. If you don’t have a dedicated marketing department, achieving this level of SEO is easier said than done. Fortunately, My Commercial Capital is dedicated to helping businesses of all sizes improve their SERP rankings and grow their enterprise. To schedule a consultation with an SEO expert, call us today.

by My Commercial Capital | Feb 17, 2023 | Blog

Businesses are always evolving. Business growth, sought after by the vast majority of business owners and stockholders, comes in a variety of forms. One of the common ways is by forming a business merger with another company or outright acquisition of another business entity.

Business Mergers and Acquisitions in Brief

Also known as M&A, mergers and acquisitions are actually quite separate from one another. Here are a few of the distinctions:

- Business Mergers. When two or more independent and separately run firms join up to form an alliance where resources can be shared or pooled, it is referred to as a merger

- Acquisitions. An acquisition takes place when one company outright purchases another to gain ownership and control. The net result is a single larger firm.

How To Finance M&A Activity

Both business mergers and outright acquisitions generally require a fair bit of working capital to put into place. Many companies need to look for funding sources to accomplish these activities.

Working capital for M&A can come from a variety of sources. If it is not self-funded, consider the following options:

- Traditional Banks and Credit Unions. There are often the first possibilities that come into consideration. Funding is often denied.

- Asset-Based Lending. In this mechanism, capital is lent using the assets of a company as collateral against the loan.

- Mezzanine Lending. This is a type of unsecured business loan based on the appraised value of the company.

The last two are offered through many financing agencies, such as My Commercial Capital.

Get The Funding You Need

If your business needs funding for M&A activity, call My Commercial Capital. They can provide your business with the financing you need to grow, merge or acquire. Their business solutions are structured to provide numerous benefits to borrowers. Connect with them today.

by My Commercial Capital | Feb 10, 2023 | Blog

A strong business credit score can aid your company in many ways, from helping it secure financing to lowering its insurance rates. If you’d like to raise your business’s credit score, the following techniques will go a long way.

Look Up Credit Reports

Business credit reports are available primarily from three credit bureaus: Dun & Bradstreet, Experian, and Equifax. The process for obtaining your business credit score differs between each agency, but doing so is worth the effort. By seeing your score, you can identify weak points to work on. You may even spot errors, and if that’s the case, you can notify the agency to remove errors and raise your score.

Make On-Time Payments

Counterintuitively, taking on debt may help raise your business’s credit score. That’s because making on-time payments to creditors is a great way to lift a business credit score. The key is to not take on more debt than your business can keep up with, as falling behind on payments is very detrimental. If you’d like to use on-time payments to lift your score, be sure to ask if the lender reports payment information to the three credit bureaus.

Use Credit in Moderation

Credit utilization is another factor that plays into every business credit score. A business’s credit utilization ratio reflects how much of its available revolving credit is in use. (Revolving credit comes from sources like credit cards and lines of credit.) Advice varies on what an ideal ratio is, but many sources recommend using 30% or less of your business’s available credit.

To maintain a good ratio, monitor your credit usage closely to make sure it doesn’t creep up, and always make on-time payments. Another option is to apply for a credit limit increase, though this option should be used sparingly and with caution.

My Commercial Capital has a variety of financing products that can help your business grow while building credit. Get in touch to learn more.

by My Commercial Capital | Feb 3, 2023 | Blog

There are many ways to grow a business. Commonly, businesses get larger by increasing sales, enlarging their market share, or occupying new market niches. Another way for businesses to grow is by the acquisition of another existing business.

Business Acquisition 101

A business acquisition is a transaction that occurs when one company purchases and gains control over another business entity. If shares have been issued by the company being acquired, then the acquiring company will become the owner of a sufficient amount of them to assume control over business operations and direction. Usually, these types of deals require quite a bit of capital, making business acquisition financing an important area to look into.

How To Finance a Business Acquisition

Just like there are many ways to get into business, there are a number of ways to obtain business acquisition financing. Here are a few to consider:

- Funding from a Traditional Bank.

The last two options are examples of alternative business acquisition financing. There are even more alternative lending options to consider. These options are often offered through a business development company or a financing agent such as My Commercial Capital.

Alternative sources are often utilized in business acquisition financing because not every company can self-finance an acquisition, the seller is not able to offer to finance, or the bank may deny funding. As part of your overall preparation, make sure that you have a detailed plan written up to share with a potential lender to help you get the best financing deal possible.

My Commercial Capital Can Help

My Commercial Capital offers a variety of solutions for businesses looking to make a commercial acquisition. They are very happy to help you find a solution that is perfect for your particular business situation. Consider calling them soon.